First Time Home Buyer Iowa Tax Credit

Historic preservation tax credit program. Some progrms that require no down payment if you qualify, but most first time buyer programs will require a downpayment.

What Your Clients Should Know For Property Investing

Through this program, borrowers receive an annual federal tax reduction equivalent to 50% of your mortgage interest up to $2,000 a year.

First time home buyer iowa tax credit. It s a tax credit against half of the mortgage interest. If you experience any trouble accessing your account or have questions, you can speak with one of our customer service representatives by. The first time homebuyers savings account fthsa is a special type of savings account that helps iowans save for a first home.

Be a military veteran with a discharge other than dishonorable who has not previously used a mortgage revenue bond program. Registration applications for projects of $750,000 or less can be submitted year round. All loans subject to a minimum 640 credit score.

Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan. (available only for married couples filing a joint iowa individual income tax return). Rmn is one of the leading providers of the mcc in the state of iowa.

Select to submit an application for part 1, part 2, or part 3. Purchase a home in a targeted area. $311,000—may be up to $381,000 in targeted areas—use the eligibility checker below to determine if the home is located in one of the targeted areas.

Buying a first home just got easier. Historic preservation tax credit program administered by iowa economic development authority. We have programs that have little to no downpayment.

The home must be occupied by the buyer as a primary residence within 60 days of closing. The iowa finance authority, ifa, is a state housing finance agency for iowa. In addition to loan and rate assistance programs, the iowa finance authority provides eligible homebuyers with a mortgage credit certificate to make homeownership even more affordable.

The account holder will also be the person eligible to receive iowa income tax deductions for contributions made to the account during the tax year. You must claim the nonrefundable credit in the year when you purchase the house. Work with rmn to sign up for the mcc.

Total amount of the credit you received. Amount you paid back to date. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Down payment assistance may be available in your area. Every year, you’re granted a direct credit on your federal taxes of 50% of the annual interest you pay on your mortgage. If you’re buying the property in partnership with a friend, partner, or spouse, the total of both your claims cannot go over $750.

The federal housing administration allows down payments as. Fha loans are the #1 loan type in america. It provides a 20% mortgage interest credit of up to 20% of interest payments.

Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which the eligible home costs are paid or. This agency delivers a variety of homebuyer assistance programs throughout the state.

The mortgage credit certificate program as a part of the mcc program, you will receive a tax credit of 50% of the interest paid on your mortgage for the year, up to $2,000. This deduction limitation is based on the account holder so even though you may have contributed to multiple accounts for more than one beneficiary your total deduction may not exceed 2 050 4 100 for married filing jointly. A network of mortgage lenders;

First time homebuyer program a new way for prospective home buyers to start saving for their first home in iowa.

If you care about preserving your wealth for your loved

What is the MCC Tax Credit? Earn up to 2,000 Per Year

Tax Credits & Rebates for FirstTime Home Buyers in

Iowa First Time Home Buyer Grants First time home buyers

New Homeowners Here’s What You Need To Know for Your

How Collections Affect Your Credit YouTube Mortgage

25 Summer Destinations to Visit With Your Kids Money

Can’t Afford a House? These Firsttime Homebuyer Grants

Congratulations on reaching your goal of home ownership Ms

First Time Homebuyer Class November 19th Home buying

USDA Loans in Greensboro NC USDA Eligibility Map Changes

How One Couple Lived RentFree for 3 Years to Save Toward

Repaying the 2008 FirstTime Home Buyer Tax Credit

Firsttime home buyer programs Statebystate home buyer

Tax Deductions and Credits for Homeowners Tax deductions

Pushback against overly tight credit after the housing

Guide to purchasing with down payment assistance. Down

One Checklist That You Should Keep In Mind Before

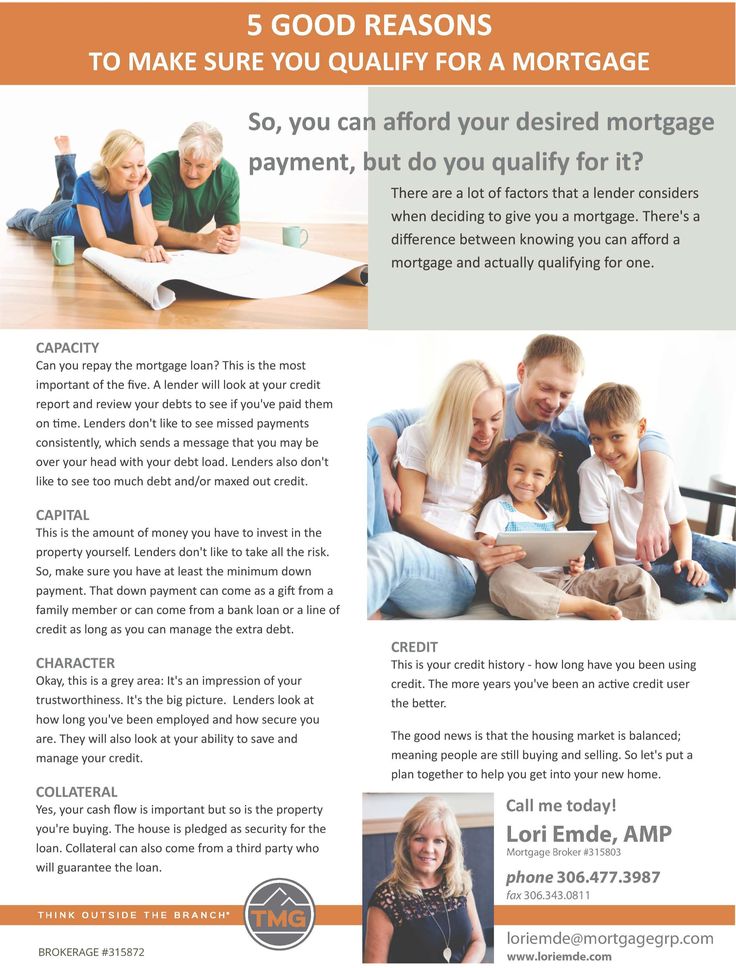

5 Good Reasons to Make Sure You Qualify for a Mortgage You

Post a Comment for "First Time Home Buyer Iowa Tax Credit"